how do i get my employer to withhold more tax

An election under section 83i applies only for federal income tax purposes. Unlike Social Security Medicare taxes do not have a wage base.

Both employer and employee hold the responsibility for collecting and remitting withholding taxes to the Internal Revenue Service IRS.

. The election has no effect on the application of social security Medicare and unemployment taxes. If you do not withhold payroll taxes and pay them correctly and in a timely manner you could even face jail time. New Hampshire and Tennessee only tax investment income and several states including Alabama Hawaii Illinois Mississippi and Pennsylvania exempt all income from pensions for state-tax.

Use Form 3949-A Information Referral PDF if you suspect an individual or a business is not complying with the tax laws. The less tax that is withheld during the year the more likely you are to end up paying at tax time. We will keep your identity confidential when you file a tax.

Dont use this form if you want to report a tax preparer or an abusive tax scheme. To get a rough estimate of how much youll get back then you need to. For federal income tax purposes the employer must withhold federal income tax at 37 in the tax year that the amount deferred is included in the employees income.

A withholding is the portion of an employees wages that is not included in his or her paycheck but is instead remitted. In 2021 this base amount is 200000 single. We dont take tax law violation referrals over the phone.

The employer cost of the Social Security tax is 62. For the most part the employer withholds these taxes on behalf of their employees but in cases where an employer does not do this or where an employee is self-employed it is the responsibility of the employee to pay these. These two taxes aka FICA taxes fund specific federal programs.

In a nutshell over-withholding means youll get a refund at tax time. Federal income tax withholding varies between employees. Report Tax Fraud.

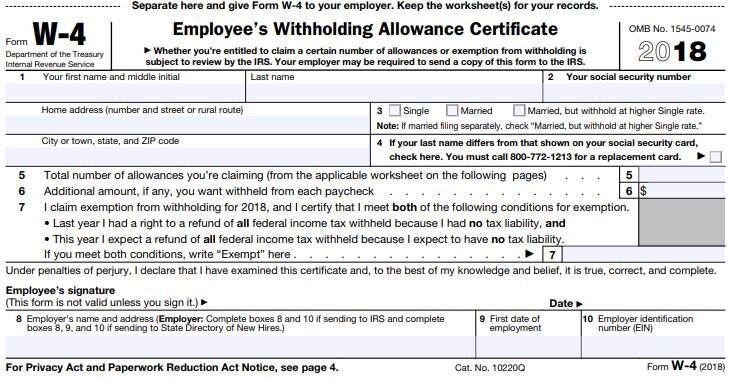

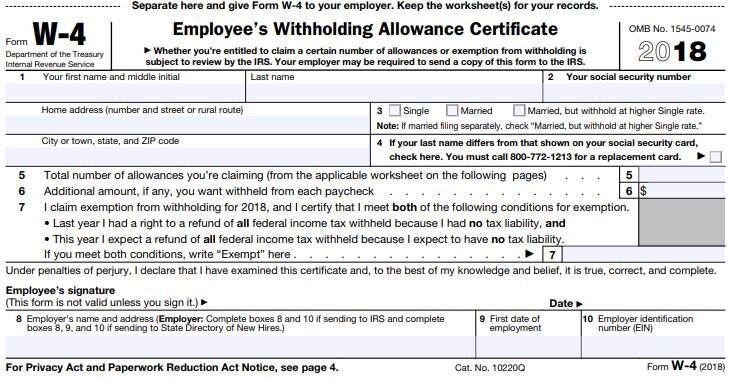

Find your total income tax owed for the year I suggest using this tax calculator for a rough estimate. Under-withholding means you. This form determines how much you and your employer agree to withhold for taxes.

Well the more allowances you claimed on that form the less tax they will withhold from your paychecks. Instead Medicare has an additional withholding tax for employees who earn more than a set amount. As an employer you have a legal responsibility to withhold payroll taxes and pay those taxes to the IRS when due.

The IRS bases FITW on the total amount of taxable wages. Medicare is 145 for both employee and employer totaling a tax of 29. Why would I owe money on my tax return.

Even if you use a payroll service you still have a responsibility to see that this is done. Social Security is 62 for both employee and employer for a total of 124.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms Blank Form Tax

Pin By Jason Ritter On Quick Saves Internal Revenue Service Tax Forms Fillable Forms

State W 4 Form Detailed Withholding Forms By State Chart

Irs Improves Online Tax Withholding Calculator Cpa Practice Advisor

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

How To Withhold Payroll Taxes For Your Small Business

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From Employee Wages And Self Employed People Need To Payroll Taxes Small Business Tax Payroll

How To Calculate Payroll Taxes Payroll Taxes Payroll Bookkeeping Business

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

How Does An Employer Withhold Tax From An Employee Taxry

Employer Withholding Department Of Taxation

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Warning To All Employees Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You Greenbush Financial Group